|

These articles first appeared in The Financialist in 2014

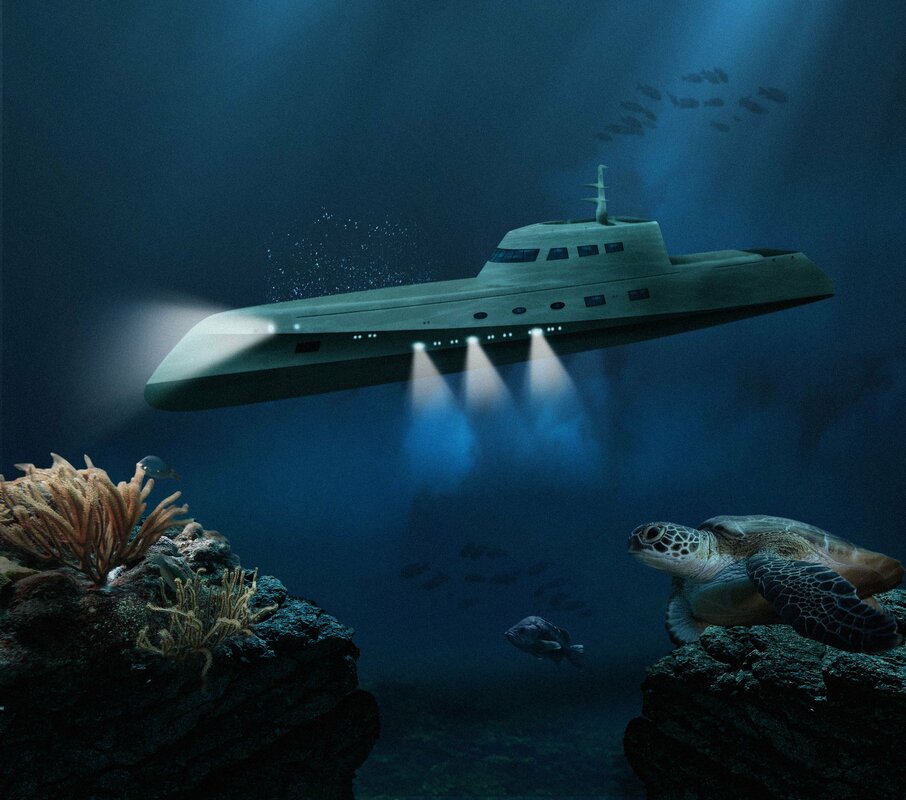

The idea of spending a night on a submarine might not be everyone’s idea of a romantic getaway. But the so-called “Mile Low Club,” launched earlier this month by British luxury property rental specialists Oliver’s Travels, offers no ordinary ride under the waves. Staffed by a captain, a chef and a personal butler, the exclusive Lovers Deep is a specially adapted submersible vessel with bespoke interior design and furniture that can be moored at any location in the world, from aside a coral reef off the coast of St. Lucia to nearby a sunken ship in the Red Sea. A “night of passion” in this over-the-top luxurious submarine starts at about $290,000. (Yes, the price includes a private speedboat transfer.) Couples can customize their stay with a champagne breakfast in bed, rose-scattering, a two-person shower and an “aphrodisiac tasting menu.” Or a helicopter transfer—but that costs extra. And claustrophobic lovers need not apply. Shopping for Stocks? Ignore Recent Growth. Common sense suggests that recent economic growth would be a reliable predictor of stock market performance. But a recent Credit Suisse Research Institute report debunks that assumption. London Business School finance experts Elroy Dimson, Paul Marsh and Mike Staunton determined that in U.S. and foreign markets, the correlation between equity returns and concurrent per capita changes in real gross domestic product was close to zero. The experts then found that hypothetical stock portfolios from economies boasting historically high rates of GDP growth actually underperformed those with stocks from low-growth countries. Stocks selected from economies that were expected to grow strongly in the future, however, generated far higher annualized rates of return than economies forecast to experience poor growth. In other words, basing investment decisions on recent high rates of economic growth can be like buying a stock after a company reports strong results - the real opportunity has probably already come and gone.

0 Comments

Leave a Reply. |

JENS ERIK GOULDJens Erik Gould is the Founder & CEO of Amalga Group, a pioneering Texas-based nearshore outsourcing firm specializing in IT, software engineering, and contact center staffing. Archives

February 2024

Categories |

RSS Feed

RSS Feed