|

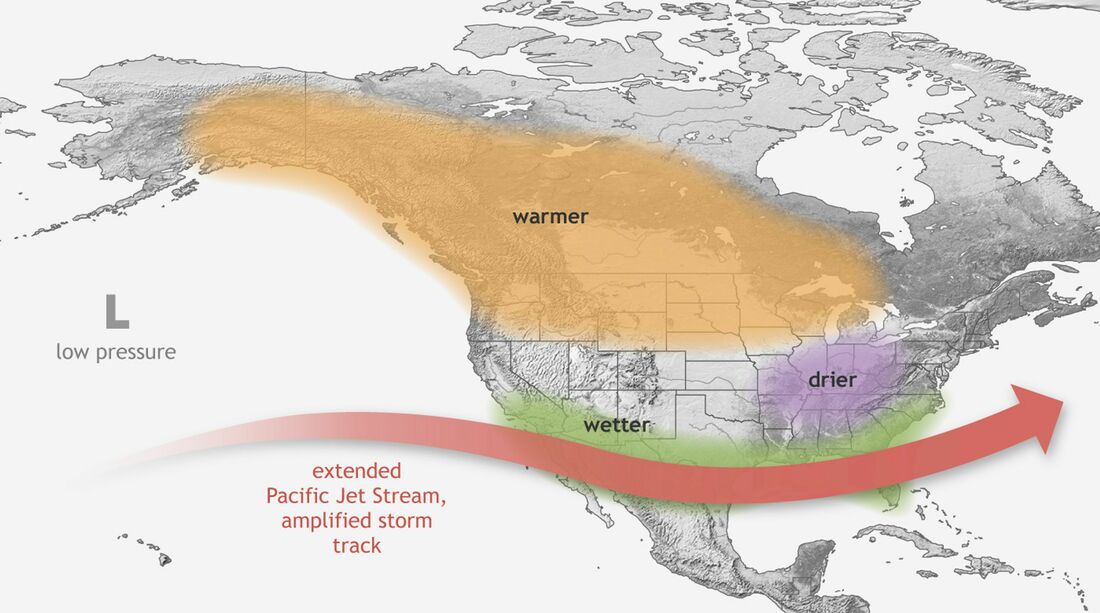

In Asia-Pacific countries, the Pacific Ocean weather phenomenon El Niño is regarded with dread, which isn’t surprising, given that El Niño brings with it severe drought and heavy monsoons. The Japan Meteorological Agency’s announcement last month that El Niño emerged this spring and might last until autumn means that it’s officially time to worry again.

A precious few, too, might actually welcome its arrival. China's weather bureau expects the pattern to cause high temperatures in the north, setting companies that make air conditioners up for a boom year. Since 2004, the four best years for air conditioner sales in China coincided with El Niño. This year, a Credit Suisse survey shows most manufacturers in China believe there is a strong chance of high temperatures this summer, and they expect a bump in sales as a result. So far in 2015, year-over-year sales have grown some 5 percent. A heat wave would clear out inventory and boost that figure toward double digits. (May 2015) Horological History On Sale This Thursday, more than two centuries of horological history will go under the hammer. The Sotheby’s Important Watches sale in New York will feature more than 250 timepieces dating back to 1780, including a rare 1951 Patek Philippe pink gold open-faced watch. The piece depicts a map of North America and nearly two dozen musical automata created by Swiss artisans during the Industrial Revolution. Some of the items are expected to go for more than $1 million, including a “Singing Bird Scent Flask” automaton that was crafted by Swiss watchmakers Jacquet-Droz & Leschot. The exquisite machine made for a Chinese buyer around 1785 is decorated with gold enamel and jewels and features a timepiece and articulated ivory bird whose song is played through a miniature six pipe organ. Another highlight of the auction is a gold snuffbox from circa-1815 that is adorned with pearls and an enamel painting of a fortuneteller reading a palm. Inside there’s an automaton featuring a woman playing a harp, a man playing a lute, and a large timepiece. (May 2015) Spin-offs Take Off Do spinoffs create value? Credit Suisse analysts looked at a series of 16 recent instances thereof in Australia and found that on average, spun-off companies – so-called “Newcos” – dramatically outperformed parent companies. On average, two years after a spin-off, parent company returns were statistically equal to those of the market. But Newcos outperformed the market by an average 30 percent. That average jumps to almost 50 percent when excluding three companies in the study that ran into regulatory trouble. (Of course, that might be why they were spun off in the first place, so to be fair, call it 30 percent.) The analysts hypothesize that new managers running Newcos are more motivated and able to focus more narrowly on operations than they did when part of a larger organization. The finding isn’t unique to Australia. Credit Suisse carried out a similar study in the U.S. two years ago and found that spin-offs performed more than 10 percent better than the S&P 500 beginning eight months after the separation. But buyer, beware: Results obviously vary considerably. Two-year returns among Australian spin-offs had a standard deviation of about 53 percent, with the worst performer earning a relative return of negative 68 percent and the best beating the market by 127 percent. First published in The Financialist

0 Comments

Leave a Reply. |

JENS ERIK GOULDJens Erik Gould is the Founder & CEO of Amalga Group, a pioneering Texas-based nearshore outsourcing firm specializing in IT, software engineering, and contact center staffing. Archives

February 2024

Categories |

RSS Feed

RSS Feed