|

Zapping Away Hunger (Jan 2015)

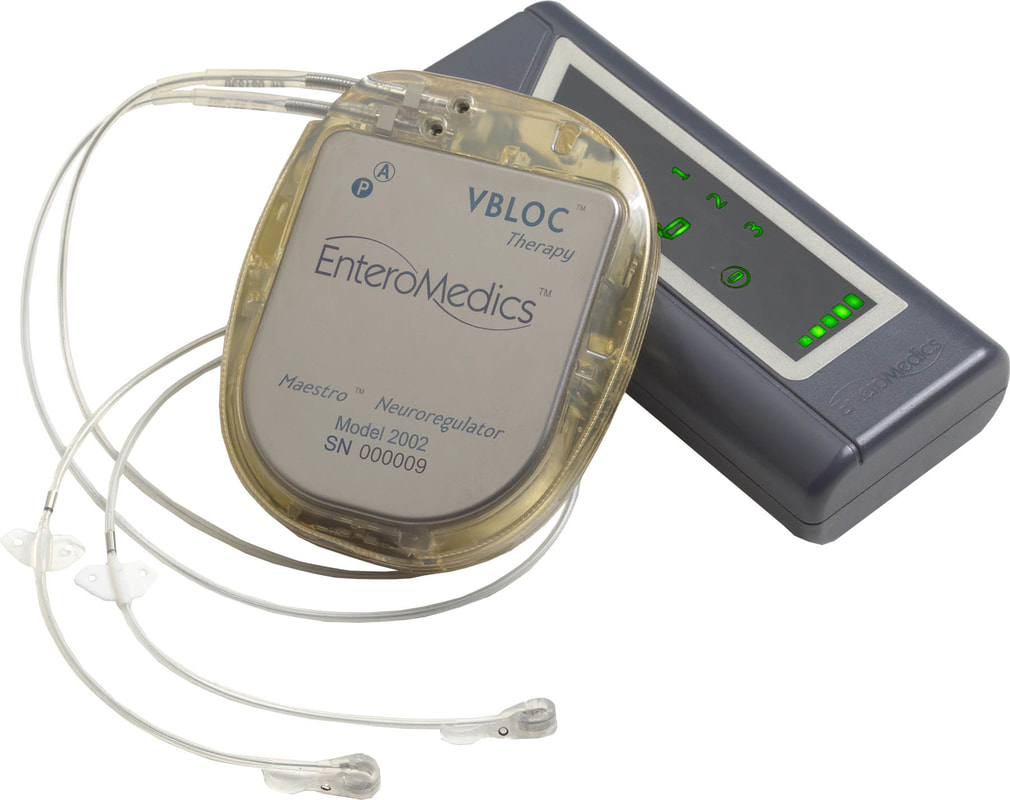

Overcoming obesity usually involves the practice of self-restraint to avoid overeating. But what if doctors could just turn off the desire to consume food? The Maestro Rechargeable System, developed by Minnesota-based EnteroMedics, is a pacemaker-like device that is surgically inserted into a patient’s abdomen, where it literally switches off hunger pains. It does so by sending electrical pulses to the abdominal vagus nerve, which tells the brain when the stomach feels empty or full. The gadget is programmed to intermittently block those nerve signals to reduce feelings of hunger in the patient, thus curbing their urge to snack or overeat at mealtime. A 12-month-long clinical trial involving 233 patients with a body mass index of more than 35, which is categorized as severely obese, found that people fitted with an activated device lost 8.5 percent more of their excess body weight than those in a control group. The results were good enough for the machine to become the first obesity device approved by the U.S. Food and Drug Administration since 2007. The Swiss Harbinger (Jan 2015) The Swiss National Bank shocked the global financial system last week by announcing that it was discontinuing its minimum exchange rate of 1.20 francs per euro. Policy makers also lowered the interest rate on deposits from negative 0.25 percent to minus 0.75 percent. But the move to weaken the currency in a bid to slow inflows and the expansion of its balance sheet, which had increased to 80 percent of GDP by the end of last year, signaled something more than about Switzerland itself. The timing of the move was key: it came just ahead of the European Central Bank’s meeting this week in which the ECB may announce quantitative easing measures. According to Credit Suisse, the Swiss action appears preemptive in nature and suggests the ECB is more likely to act, since QE would likely to further weaken the euro and would have increased inflows to Switzerland. In fact, Credit Suisse analysts calculate that there’s a 70 percent chance that the ECB will announce sovereign bond purchases, and a 50 percent chance they’ll aim to purchase 500 to 750 billion euros worth. What will be the effect on the euro? Credit Suisse cut its forecasts to 1.12 euros to the dollar in three months and 1.05 euros in one year. Could Mexico Tighten More Than Expected? (Jan 2015) Mexico’s central bank may hike interest rates more than Wall Street expects this year. Credit Suisse forecasts a full percentage-point increase in the overnight rate to 4.0 percent from 3.0 percent, while market consensus forecasts the rate will sit at 3.6 percent by year-end. The reasons for the more hawkish call? The peso has lost 12 percent since September, and that could endanger the bank’s 3 percent inflation target, especially after it missed targets in 2014. Conversely, higher rates could help show the bank’s resolve to strengthen the peso and fight inflation. The bank cut rates by 1.5 points in 2013-14, giving it space to tighten monetary policy. As Credit Suisse analyst Alonso Cervera asks, “If this is not the time to undo these cuts, then when?”

0 Comments

Leave a Reply. |

JENS ERIK GOULDJens Erik Gould is the Founder & CEO of Amalga Group, a pioneering Texas-based nearshore outsourcing firm specializing in IT, software engineering, and contact center staffing. Archives

February 2024

Categories |

RSS Feed

RSS Feed