|

Mapping America’s Religious Beliefs

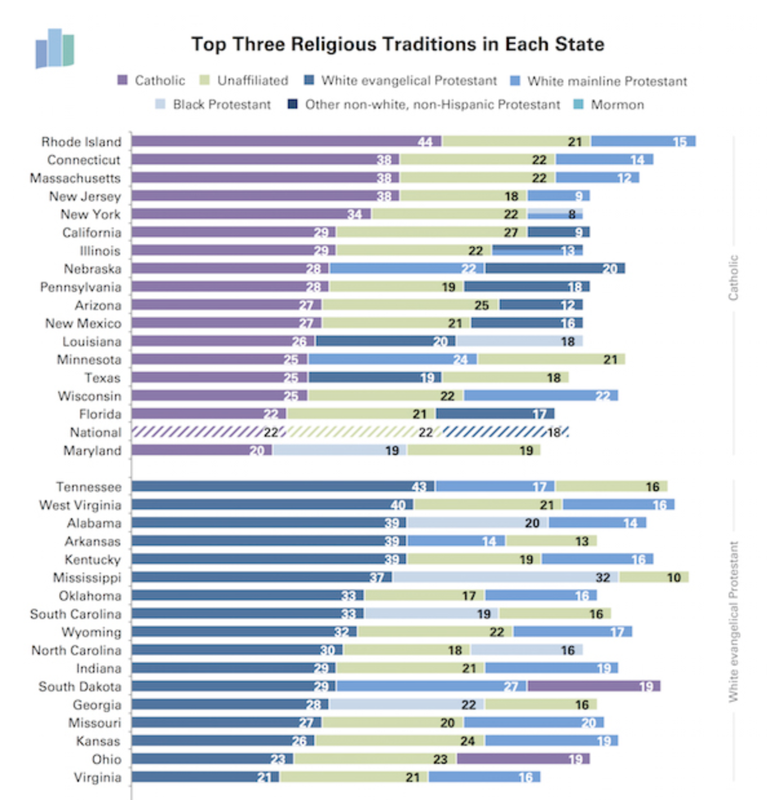

Oregon is the most godless state in America. That’s according to the Public Religion Research Institute’s American Values Atlas, which is based on telephone interviews with 50,000 people across the country. This year’s results show 22 percent of the U.S. population claims to be “unaffiliated” with any religion, the same percentage of people who describe themselves as Catholic, and four percentage points more than those who call themselves Evangelical Protestants. Those who don’t identify with any religion actually outnumber believers in 13 states, mostly in the northwest and northeast of the country. In Oregon, 37 percent of those surveyed describe themselves as religiously unaffiliated, edging out New Hampshire (35 percent) and Washington (33 percent). Catholicism is the No. 1 religion in 17 states, led by Rhode Island (44 percent). Utah is the least pluralistic state: 56 percent of people there are Mormon, making it the only state where more than half of the population follows the same religion. The Trouble with Market Expectations Is the market really all-knowing? Perhaps. But according to the San Francisco Federal Reserve, it isn’t to be trusted when it comes to its “views” of future economic policy, in large part because changes in risk and liquidity premiums can affect asset prices as much as investors’ views about the future of interest rate, inflation, or the like. Consider the breakeven inflation rate, or BEI — the difference between nominal and inflation-adjusted bond (TIPs) yields — which provides a market-based expectation of future inflation. Since the middle of last year, they’ve fallen from 2.5 percent to 1.8 percent. Taken at face value, this would suggest that the market sees future inflation running below the Fed’s longer-term inflation target of 2 percent. If the Fed used a “market-based” approach to setting policy, it would be seriously considering cutting rates in order to get BEI back to the target. But the Fed isn’t thinking about taking on a more accommodative stance in order to fuel inflation; if anything, it’s expected to raise rates. Other factors — such as falling European sovereign bond yields and subsequent increased capital flows from Europe to the U.S.—may have just as much to do with driving down BEI rates than actual U.S. inflation expectations themselves. Policymakers should always keep an eye on financial market prices, but it would seem very unwise indeed to formulate policy solely on the basis of such. Go Small or Go Home When it comes to the performance of developed economies, it turns out that smaller might actually be better. In a new report, “The success of small countries and markets,” Credit Suisse compared the economies of Austria, Belgium, Denmark, Finland, Norway, Portugal, Iceland, Ireland, Sweden and Switzerland to their larger brethren, and the findings were instructive. Small countries’ cash flow return on invested capital, a proprietary Credit Suisse metric, is consistently about 3 percentage points higher in those smaller countries than in larger ones. Equally interesting is the fact that their economies are increasingly useful as leading indicators for the global economic cycle. Fiscal balances in the countries of Northern and Continental Europe, for example, had begun to deteriorate in 2007, about two years ahead of larger European countries. And which small country is a good indicator for the future fortunes of the U.S.? Singapore. The southeast Asian country’s fiscal policy tends to follow the changes in U.S. fiscal numbers, with a track record of creating excess capacity in advance (and apparently anticipation) of American demand. These articles were first published in The Financialist in April 2015.

0 Comments

Leave a Reply. |

JENS ERIK GOULDJens Erik Gould is the Founder & CEO of Amalga Group, a pioneering Texas-based nearshore outsourcing firm specializing in IT, software engineering, and contact center staffing. Archives

February 2024

Categories |

RSS Feed

RSS Feed